Writing a retrospective of how our portfolios performed in 2019 feels very strange in light of how 2020 has started. The sharp sell-off that took place during December 2018 feels almost quaint in comparison to the turmoil of the past several weeks. Fortunately equity markets managed to rebound at the beginning of 2019 and most investors saw positive returns early in the new year.

Towards the middle of the year markets began adjusting to distortions caused by uncertain and, at times, contradictory world economic policy. The market slowdown was a consequence of the shakeup in global trade and political upheaval that included Brexit.

Still, markets managed to absorb this uncertainty and by the end of 2019 most markets were showing positive returns. This response was largely a consequence of an increasingly favourable investment outlook. Analysts felt better placed to forecast emerging trends and this helped drive market optimism. The combination of low interest rates with solid technology sector performance contributed to 2019’s strong finish.

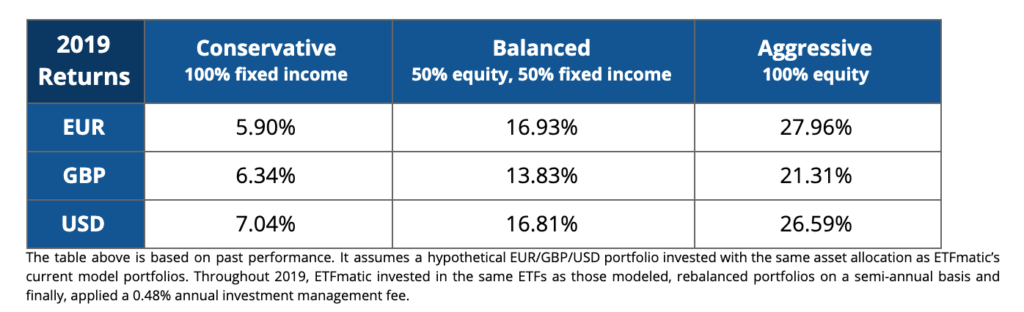

The table below presents the performance of 3 of the 21 model portfolios that make up our standard investment management proposition:

As your discretionary investment manager, we want to emphasise how important it is for our clients to continually reassess the most suitable asset allocation for their investment goals. The target asset allocations of your portfolios should match your risk appetite.

We take this opportunity to remind you that you are able to choose the exact percentages you would like to invest in each region through an ETFmatic custom portfolio. You can read more about our investment offerings in our whitepaper.

As always, ETFmatic remains committed to making investing as simple, cost-effective and straightforward as possible.