As part of our ongoing review of our asset allocation and underlying instrument selection, we have made the following changes to our Starter portfolios.

Review of Regional Weights on Starter Portfolios

The weights of the equity regions have been updated to match the regional weights and market capitalisation of the World equity markets according to the MSCI ACWI (our representative index).

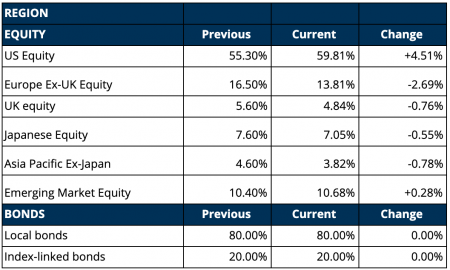

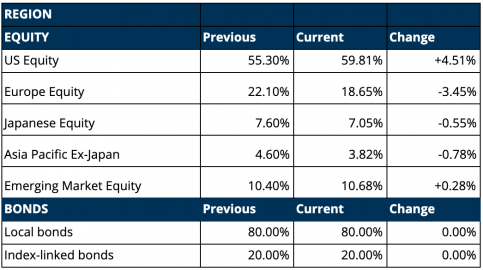

The weights of the two bond regions will continue to be divided between local (80%) and Inflation linked bonds (20%).

The changes applied on EUR and GBP Starter portfolios are the following:

The changes applied on USD Starter portfolios are the following:

These changes reflect an increase in the world’s capitalisation share of the US market followed by a lighter increase in Emerging markets. On the other hand, we see a decrease in the world’s capitalisation share of European and Asian markets.

These changes are now applied to all our Starter portfolios as our aim to replicate the MSCI World index for the equity side of our portfolios.

Please remember that the target allocations of Custom Portfolios are defined by the client, who also decides how frequently to change it so those kind of portfolios are not affected by the update of the weightings among regions.

Review of instrument selection

We will continue to use the current range of ETFs to construct the investment portfolios; We have identified some possible ways of reducing the TER of the Index-linked bonds, and additional changes may follow in Q1 of 2020.