Strategy Overview

Markets rebounded during the second quarter of 2020. ETFmatic’s portfolio performance was driven by the reopening of economies and the support provided by central banks and governments to get ahead of the pandemic crisis.

Investors looked for opportunities to benefit from the early stage of market recovery due to their expectations of having left behind the worst of the pandemic as the economy presented signs of recovery.

Global markets moved upwards as a result of the more positive global macro outlook. Equity and credit markets were especially supported during this period and the USD strengthened once again as investors facing currency uncertainties allocated funds into the currency (considering it a safe haven).

Additionally, financial markets also benefited from the agreement amongst oil producers to temporarily cut production.

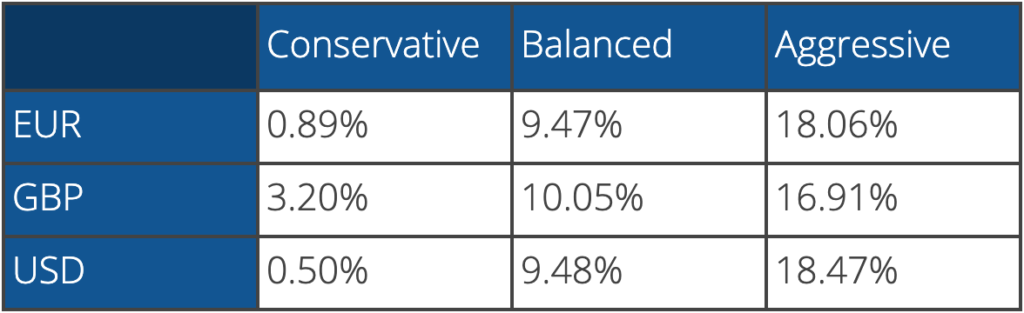

The table that follows presents the performance of 3 of the 21 model portfolios that make up our standard investment management proposition.

2Q 2020 Returns

Conservative: 100% fixed income

Balanced: 50% equity / 50% fixed income

Aggressive: 100% equity

Market behaviour during this period has highlighted how important it is for investors to follow investment strategies that fit with their risk appetite and financial goals.

We have taken advantage of this period and implemented new products that offer a wider range of investment options. We believe these additional investment strategies provide our clients with more choice and enable them to choose a strategy that more closely matches their investment objectives.

Some of our new offerings…

Thematic Portfolios

This investment approach is focused on investing in assets that are set to benefit from major economic, technological and societal trends of a structural nature that will have a significant impact on the world.

Thematic Portfolios are very straightforward to set up. Clients simply select one of the three predefined Thematic Portfolios which is suitable for them based on three broad risk categories: Low, Medium and High risk asset allocations. The higher the allocation to equities, the higher the exposure the client will have to thematic investments.

Adaptive Portfolios

ETFmatic has partnered with Mads Pedersen (former head of UBS Global Asset Allocation team, where he managed strategies with more than $100bln in assets) to bring a new approach to managing risk, that combines machine learning & algorithms with the experience of a world-class asset allocator.

Starting from a base ETF portfolio (defensive / balanced / dynamic), Mads’ system provides a signal to go risk off / on, aggressively decreasing / increasing the portfolio’s equity exposure. Looking at the recent past, this has happened 2-6 times per year and has resulted in avoiding the worst of the draw downs in Q4 2018 and the most recent one in Q1 2020.

Until next time, stay healthy, well and safe too.

As always, we thank you for trusting us with your money as we stay committed, through hard work, to continuously provide you with the most simple, straightforward and cost effective tools to manage your investments.

The table above is based on past performance. It assumes hypothetical EUR/GBP/USD portfolios invested with the same asset allocation as ETFmatic’s current model portfolios. Throughout Q2 2020, ETFmatic invested in the same ETFs as those modeled, applied a 0.48% annual management fee and rebalanced portfolios on a semiannual basis.

With all investments your capital is at risk and the value of your investments and the income deriving from it can rise as well as fall. Past performance is not a guide to future performance. Past performance is not a guarantee of future returns and data and other errors may exist.

ETFmatic Ltd is a company authorised and regulated by the Financial Conduct Authority (No. 657261. ETFmatic LTD is a limited liability company registered in England and Wales, no. 08856747, with a registered office at 4th Floor 7-10 Chandos Street, Cavendish Square, W1G 9DQ, London, United Kingdom. ETFmatic Ltd is registered for VAT with the HMRC with registration number 190 8981 63. The custodian of our clients’ money is Barclays Bank, while the ETFs are held by Saxo Bank in an account in the name of ETFmatic Global Nominees Ltd.