Investment as a Service

Profitable Business Extension

IaaS model enables revenue generation from existing client base

Increased engagement and client retention

Managed Portfolios improves client retention by connecting emotionally with clients about long term aspirations and hopes. This also enables more personal communication with clients.

Attractive alternative in a low interest rate environment

Significantly better for banks than holding excess client deposits; Significantly better for clients than low/no interest rate accounts.

Quick time to market

Agile turnkey solution with the required regulatory permissions, technology solution and operations with quit time to market

Profitable Business Extension

IaaS model enables revenue generation from existing client base

Increased engagement and client retention

Managed Portfolios improves client retention by connecting emotionally with clients about long term aspirations and hopes. This also enables more personal communication with clients.

Attractive alternative in a low interest rate environment

Significantly better for banks than holding excess client deposits; Significantly better for clients than low/no interest rate accounts.

Quick time to market

Agile turnkey solution with the required regulatory permissions, technology solution and operations with quit time to market

Investment Propositions

Thematic

Thematic propositions, including ESG, energy, technology, or a blend that best suits your audience. These are smart beta portfolios created by ETFmatic and implemented on request.

Premium

World class asset allocation strategies, such as our Adaptive portfolios developed together with the former UBS CIO, Mads Pedersen.

Global Portfolios

Passive model portfolios that give market cap weighted exposure to global equities and local government bonds.

Bespoke to meet your needs

Instruments, asset classes and portfolios created and incorporated by partners.

We’re modular in nature and in our Pricing

Finax and ETFmatic have created an investment platform that seamlessly integrates into our partners existing business.

Finax Investment Services

Manage investment propositions, model portfolios, rebalancing strategies, etc.

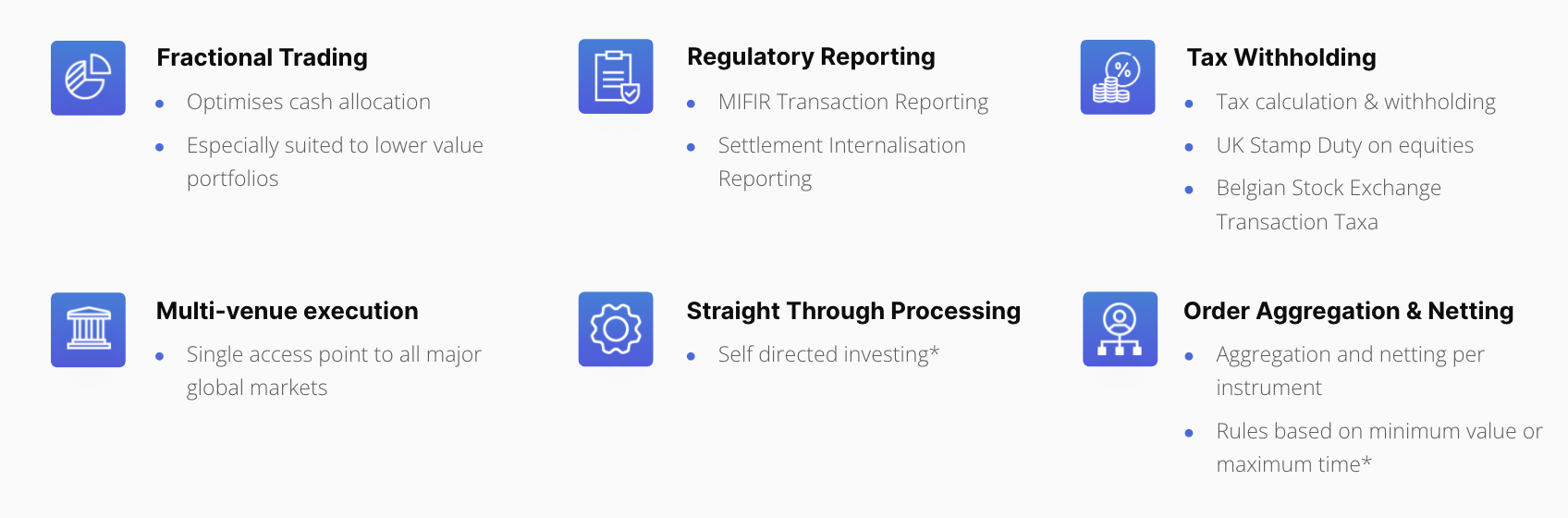

Process cash into and out of client portfolios, monitor for fraud and AML.

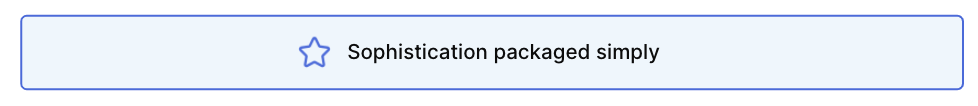

Prepare order plans, act on exchanges across Europe, confirm trade execution.

MIFID Suitability and attitude to risks. Open Interface for KYC & Client Risk Assessment.

Safe custody of client assets & cash, trusted servicing of corporate actions

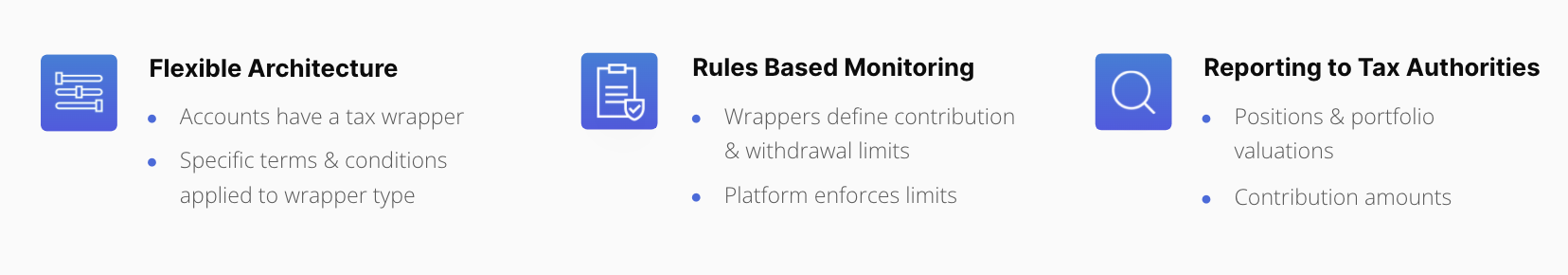

Rule-based monitoring of permitted client contribution limits.

Portfolio Management

- Traditionally discretionary investment management services were tailored to high net worth individuals and institutional investors, and had minimum investment requirements often starting as high as 250,000.

- While automation and digitalisation has enabled these services to be provided to lower account sizes, this has often been done by fitting each client into a predefined “model portfolio”.

- The ETFmatic platform takes this one step further by managing each client’s investments individually, based on specific instructions (“mandate”) on each individual portfolio.

- It does this in a way that allows for complete customisation and integration with other services.

Order Execution

Cash Management

Client Life Cycle

Asset Custody and Settlement

Accounts and Tax Wrappers