The third quarter of 2020 has been no less suspenseful than the first 2 quarters. The pandemic has devastated large swaths of the global economy. The main drivers of market performance during the past several months were fears of new COVID-19 outbreaks and an overall loss of confidence in the economy, and governments’ responses to this.

There is also tremendous uncertainty regarding significant political events, such as the upcoming U.S. election and Brexit, which is playing on the minds of investors. These events have the potential to generate pronounced market volatility over the next few months. According to some studies, higher volatility can indicate a higher probability of a declining market.

During the third quarter we have seen global equity markets underperforming U.S. equity, which is at historic highs. This is largely as a result of high U.S tech stock valuations. Furthermore, fixed income markets have also been impacted by the new economic environment, as is observed by low inflation and low government bond yields across the globe.

According to the OECD all G20 countries, except China, will have suffered a recession in 2020. The organisation expects a slow recovery throughout the course of 2021, and is forecasting that by the end of next year the global economy will still be below the levels seen at the end of year 2019.

The overall economic outlook remains uncertain and dependent on the broader impact of the virus, fiscal and monetary policies, people’s behaviour and confidence, and the outcome of political events.

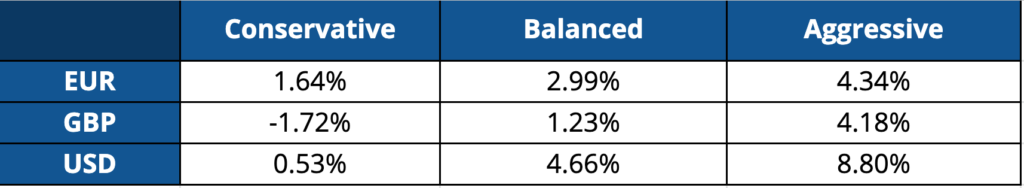

The table below presents the performance of 3 of the 21 model portfolios that make up ETFmatic’s standard investment management proposition:

3Q 2020 Returns

Conservative: 100% fixed income Balanced: 50% equity / 50% fixed income Aggressive: 100% equity

The table above illustrates how important it is to diversify your investments and to choose an asset allocation that matches your investor profile and risk exposure tolerance.

However, rest assured that we are continuously working to improve our service so that we can keep providing you with the best possible alternative to manage your investments through a simple, effective and cost-efficient investment tool.