Portfolio performance in the first quarter of 2020 was mainly impacted by the spread of coronavirus across the world.

Investors’ fears about an upcoming crisis in the wake of the spread of the virus and the moving of funds to fixed income assets caused a fall in bond yields and a rise in their price, as well as a considerable equities sell-off. Investors and corporations, facing domestic currency uncertainties, considered USD a safe haven once again, resulting in a strengthened USD

Despite the policy efforts of governments in more advanced economies and the measures taken to support businesses and households and to reduce borrowing costs, financial markets across both developed and emerging markets fell sharply as a result of the pandemic we are experiencing.

Besides the coronavirus lockdown, markets were negatively affected by low oil prices. Oil producing countries have been struggling to reach a deal to lower the world supply temporarily. The need to lower the world’s supply stemmed from the slowdown of the worldwide economy.

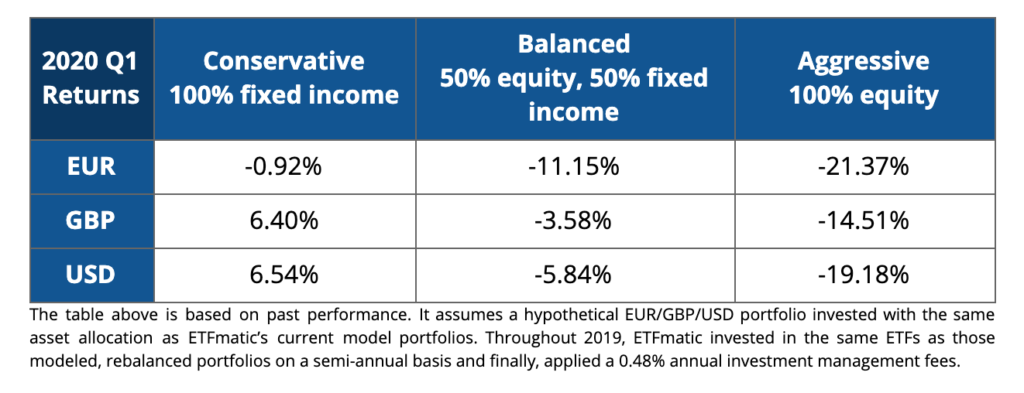

The table below presents the performance of 3 of the 21 model portfolios that make up our standard investment management proposition:

This quarter has provided a clear example of the importance for investors of choosing the risk exposure that matches their investment profile. With the volatility we are experiencing in the market, selecting an appropriate asset location has become crucial in investment choices and selecting the asset allocation that matches your risk appetite is vital.

You can read more about our investment approach and offerings in our whitepaper.

We thank you for trusting us with your investments and keep committed to providing you with the most simple, straightforward and cost effective tool to manage your investments.