In the process of developing our rebalancing methodology we reviewed several research papers investigating the efficiency of rebalancing strategies. Then, we have taken into account trading and settlement cycles of the assets that constitute our portfolios to provide an additional layer of optimization. As a result, we have implemented a portfolio rebalancing methodology that can be best described as opportunistic rebalancing (Daryanani, 2007), with the key parameters fine-tuned to achieve the balance between maintaining the risk at the desired level and keeping the associated transaction costs low.

However, our platform can accommodate different rebalancing approaches. Our adaptive portfolios are rebalanced to target weights only when a discretionary signal is generated – for the rest of the time they are allowed to drift along with market movements.

Tolerance Bands and Inner Rails

Rebalancing a portfolio back to its target weights too frequently might often result in triggering unnecessary trades where the tax and transaction cost implications outweigh the benefits of keeping the risk at the targeted level. As suggested in the aforementioned research paper, a better way to manage rebalancing is to allow portfolios to drift slightly from the target allocations. How far from the target a portfolio is allowed to drift is referred to as the tolerance bands. The aim is to set the tolerance bands in place that are wide enough to allow for natural drift to occur and prohibit costly frequent rebalancing, whilst narrow enough so that the portfolio’s asset allocation mix adheres to the desired risk profile. What is more, when selling off assets to rebalance, it is possible to further minimise the implicit and explicit costs of trading by reducing only a part of the distance from the target weights. The exact amount of this reduction is controlled by the inner rails parameters.

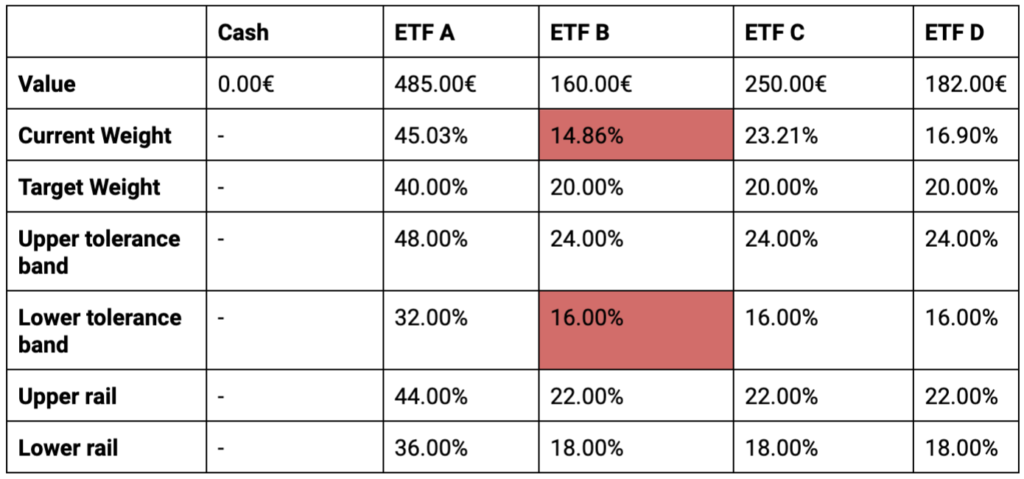

For our Global and Thematic Portfolios we have chosen to set tolerance bands that are 20%, on a relative basis, on either side of a portfolio’s policy weight. This means that for a target weight of 20% the tolerance bands will amount to 16% and 24%. We have further decided to set inner rails at the level of relative 10%, which results in reducing half of the distance from target weights when rebalancing. According to our research and experience these values offer the most compelling balance between portfolio returns, frequency of trades (associated costs) and adherence to the portfolio’s policy weights.

Our approach to rebalancing portfolio is described in the following example:

User has a portfolio with four ETFs (A, B ,C, D) with target asset allocation (40%, 20%, 20%, 20%), tolerance bands set to 20% for each side and inner rails to 10% for each side. Due to the price fluctuations, ETF B breached the lower tolerance band. Therefore the portfolio needs to be rebalanced. The system will sell positions outside of the upper rail in order to buy assets that are below the target weights.

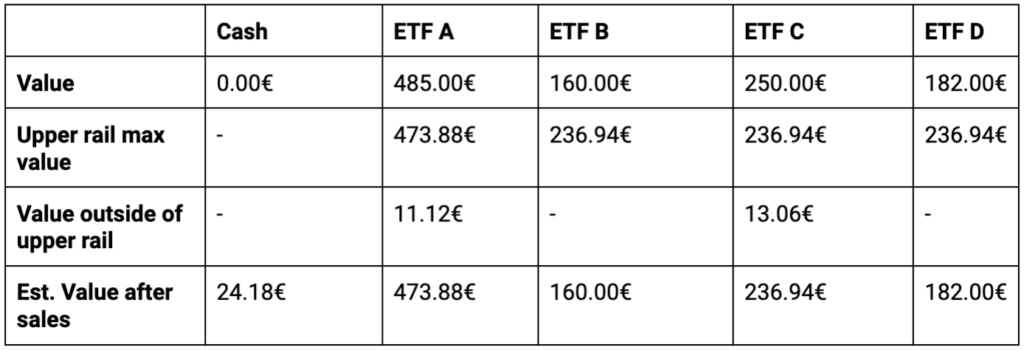

During the first step, our system computes the amount of cash that comes from selling ETFs outside of upper rails (ETF A and C). This cash, together with the current cash balance (0 in this case) will be used for the second step of rebalancing.

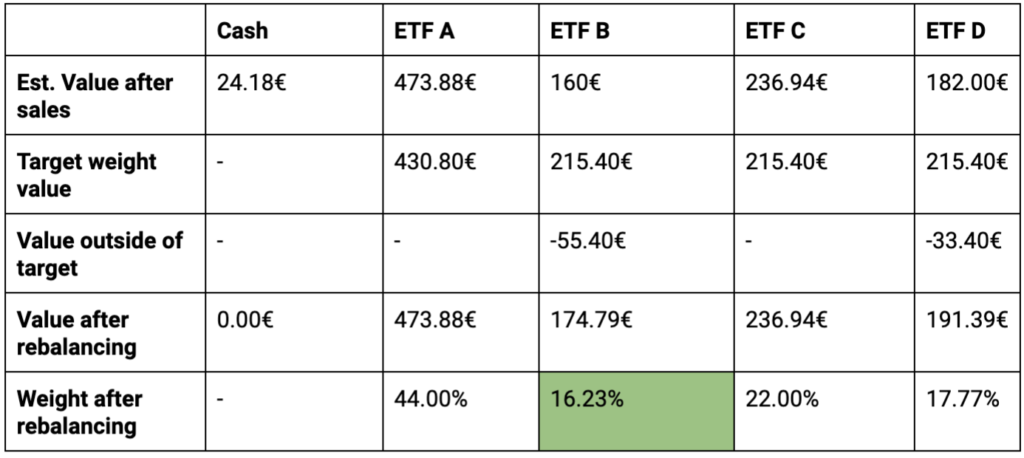

The amount of cash from selling ETFs A and C is lower than the amount needed to bring ETFs B and D back to their target weights. Therefore the cash will be allocated according to the relative distance of each of the ETFs from its target weight – in this case more of the ETF B is purchased.

Monitoring Frequency

The tolerance bands define what are the necessary conditions for the rebalancing to happen, but the triggering of the process does not have to happen immediately. This aspect is controlled by the monitoring frequency parameter. Our review of the literature points to the conclusion that observing the rebalancing conditions at least biweekly is recommended. However, the frequent monitoring comes with additional costs on our side so we have introduced segmentation in this aspect using a threshold portfolio value (25 000 EUR, GBP or USD).

Portfolios above the threshold value

We looked at the minimum size and potential frequency of trades and decided to implement monitoring during every trading session for portfolios in this bracket. This means that every time we trade (currently 3 times per week) we compare the currently observed weights of each portfolio holding a balance equal to or above the threshold value to lower and upper tolerance bands and, if necessary, take action to bring the allocation to the inner rails.

Portfolios below the threshold value

The size of the trades and the costs involved do not justify a frequent look methodology for portfolios below our threshold amount. For this segment we have therefore implemented a semi-annual look and rebalancing methodology. We use the exact same tolerance bands, inner rails and rebalancing logic. What differs is that after every rebalancing we pause the monitoring process of all portfolios of less than the threshold amount for six months. After this period we will again start comparing current weightings to their tolerance bands and adjust them to the inner rails for the ones that exceeded the allowed level of deviation from target. The period without monitoring is fully configurable and depends solely on the client’s preferences.

Target weights adjustments

All our portfolio offerings have target weights for each underlying asset. Global and Thematic Portfolios have these weights updated once per year to reflect changes in the composition of tracked indices. Adaptive Portfolios are adjusted whenever the asset allocation algorithm generates a signal. For Bespoke Portfolios, the frequency of updates is fully customizable during the portfolio creation process.

During the target weights adjustment process we monitor all our portfolios for rebalancing – if the new allocation causes portfolio constituents to exceed tolerance bands, rebalancing transactions are triggered.

Rebalancing effect of new contributions

Depending on the portfolio strategy, we might use additional inflows from clients to bring portfolios closer to the target allocation. This is the case for our Global and Thematic Portfolios – when a new contribution is registered, our system generates asset purchase orders using target weights as an input. Please have a look at the example below:

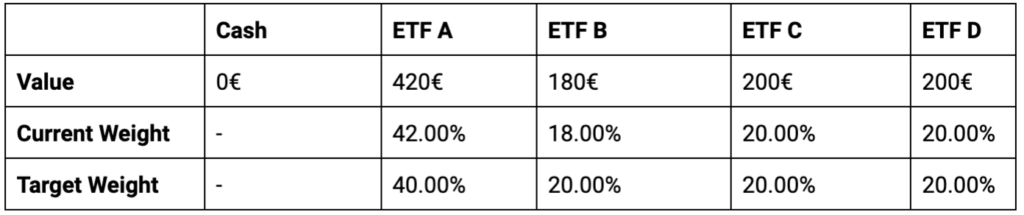

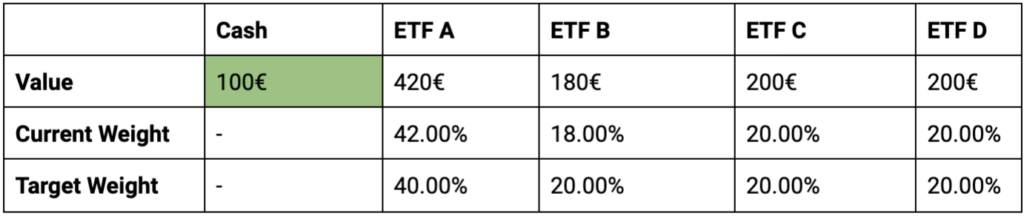

User has a portfolio with four ETFs (A, B, C, D) with current asset weights equal to (42%, 18%, 20%, 20%) and target asset allocation: (40%, 20%, 20%, 20%):

User deposits additional 100€:

1st trading window: new funds are invested in a way to bring the portfolio closer to the target allocation:

Additional remarks:

Cash is not treated by the system as an asset class, portfolio weights are computed on a 100% ETF allocation basis – adding additional cash to the portfolio does not cause changes in instrument weights.