Portfolio rebalancing is an important concept for all investors to understand. As any investor knows, the markets are constantly moving, which means making adjustments is a fundamental step that keeps your portfolio aligned to your risk tolerance. Stocks, bonds and other asset classes all have an important role to play in your portfolio, and in this article, we highlight several important rebalancing strategies to know.

First, what is Portfolio Rebalancing?

1. Portfolio Rebalancing Explained

For all investors, the first step to set up an investment portfolio is identifying your risk tolerance – done through the MiFID process – and deciding on an asset allocation. Choosing a strategy involves deciding what percentage of your portfolio you want to have in stocks, bonds, treasury notes, and other investment vehicles. Having a balanced portfolio can help ensure steady growth and minimize the impact of market fluctuations and is an important part of a long-term investing strategy.

After setting up your portfolio, it is important to assess the performance of each asset class periodically. If one asset class overperforms, then that class will be overrepresented in your portfolio. This overrepresentation can lead to changes in your portfolio’s risk profile.

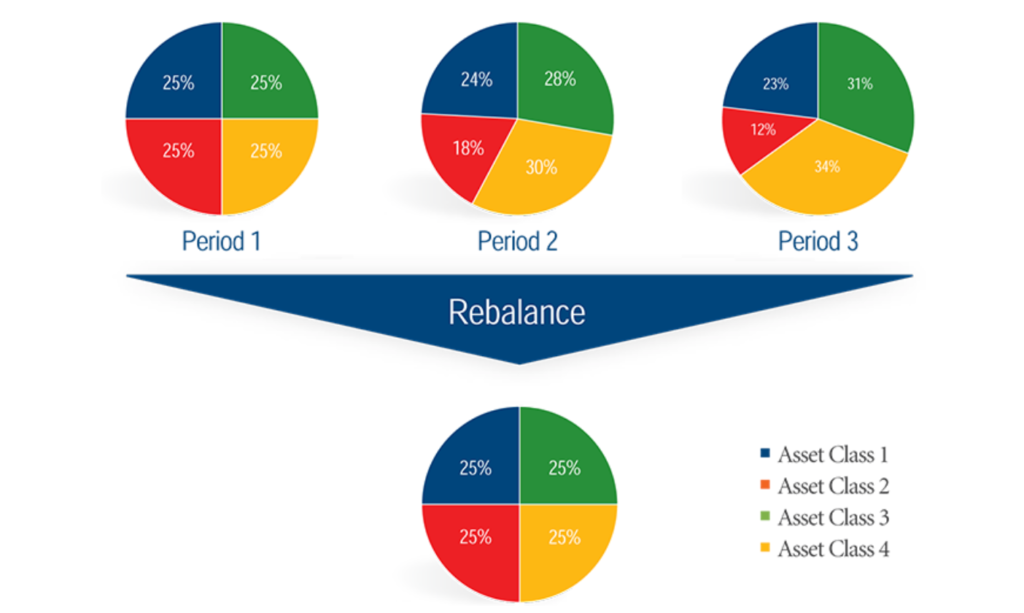

To stay aligned to your risk tolerance, portfolio rebalancing is necessary. By increasing holdings in the “underperforming” categories or decreasing holdings in “overperforming” categories, the asset allocation within your portfolio will return to the original distribution.

In this example, the investment portfolio begins with four different asset classes equally balanced. Over time, Asset Class 3 and Class 4 outperform, which increases their value from 25% of the portfolio to 31% and 34% respectively. After rebalancing, the portfolio returns to the original allocation, with yellow and green being reduced back to 25%.

2. Why is it Important to Rebalance your Portfolio

Portfolio rebalancing is important to help generate consistent returns. In general, asset classes that overperform in one year will likely return closer to normal the next year. In order to stick to your investment strategy and maintain your same level of risk, rebalancing is necessary. Keeping portfolios within your risk tolerance allows you to remain committed to your original strategy.

The cyclical nature of the economy often means that certain asset classes will outperform others over time. During these cycles, it is important to pay attention to how your portfolio is performing and take actions to maintain an asset allocation aligned to your original risk tolerance. Not rebalancing can drastically reduce your overall returns throughout the various phases of market ebb and flow.

3. Does risk tolerance influence portfolio rebalancing?

One of the most important questions to ask yourself is ‘what is my risk tolerance’. For those who are comfortable with increased levels of risk, more unpredictable assets like stocks should be weighed higher in your portfolio. For those who are very uncomfortable with risk, a portfolio with a higher weight of traditionally safe investments like bonds is likely the best choice. Other factors to consider include age, retirement goals, time horizon and savings. Over the years, it is likely that your strategy may change, and the asset allocations within your portfolio should be redistributed to reflect that.

4. When should you rebalance?

Deciding when to rebalance is another personal decision that depends on a variety of factors. Semi-annually, quarterly or monthly are all potential ways to rebalance. It is important to remember that there are costs to rebalancing and too frequent rebalancing will generate transaction costs that will impact your portfolio performance.

Another strategy is to look at percentage thresholds rather than time periods when deciding when to rebalance portfolios. This method involves picking a set target percentage and rebalancing whenever a certain asset class reaches that particular number (for example, rebalancing every time X asset class is 5 percent over or underweight of your original asset allocation). This requires investors to pay careful attention to their portfolios and make changes on the fly, which is time intensive. That said, new technology-first investment platforms use sophisticated algorithms to automate this process in a quick and efficient way.

5. How do you rebalance your portfolio?

Rebalancing can be done using a few different methods. Most commonly, existing assets will be either bought or sold in order to rebalance. Remember, there are costs associated with buying and selling assets. This might include commissions on stocks or mutual funds, as well as potential tax implications of selling stocks at a profit or at a loss.

Additionally, investors can also allocate new money appropriately as a strategy for rebalancing. This means that new deposits into accounts are used to purchase assets that have become underweighted in your portfolio until a balance is reached again. This second method is usually more popular than the first, as it does not involve selling off assets that are performing well. Investors are usually hesitant to let go of well-performing investments, and this second method gives them the ability to rebalance without having to take that action.

ETFMatic’s Technology-led Rebalancing Solution

We are an automated wealth management platform that uses proprietary technology with human supervision to provide ongoing portfolio management.

In deciding our rebalancing methodology, we reviewed several research papers that delved into the ideal frequency and best methodologies for rebalancing. With this in mind, implemented a portfolio rebalancing methodology that uses twice weekly (for GBP, USD, EUR 25,000 and above) and semi-annual (GBP, USD, EUR 25,000) looks along with set tolerance bands and inner rails relative to a portfolio’s target weight.

- With our Starter Portfolios these weights are updated once per year to reflect changes in the market caps of the different indices.

- The target weights of Custom Portfolios will change if a client decides to change their asset allocation or liquidate their portfolios.

Rebalancing a portfolio back to its target weights too frequently might often result in triggering unnecessary trades where the tax and transaction cost implications outweigh the benefits of keeping the risk at the targeted level. Our solution uses a data-led approach to balance in the most trade-efficient way in order to keep a portfolio to a client’s risk level and save on trading fees. This makes our rebalancing solution optimised, so our client’s keep more of their returns.