Launch your investment platform and generate more revenue in weeks with ETFmatic Embedded Investing.

Customizable white-label investment management tool that transforms boring savings into profitable investments.

World's Fastest

Investment management for everyone, through brands they trust.

Billions worth of savings sit in low-interest accounts. Today's consumers are starting to understand that unattractive interest rates can't help them build wealth. So why do they keep putting money in the same low-interest environment?

Traditionally discretionary investment management services were tailored to high net worth individuals and institutional investors, and had minimum investment requirements often starting as high as 250,000.

Most people don’t want to pay the high fees or put in the time required to manage their money themselves. Financial advisors and institutions are well positioned to convert these savings into investments.

The modern wealth management industry is constantly evolving. Financial advisors and institutions – who often have deep client relationships – can leverage technology to help their customers convert passive savings into more profitable investments.

The question is, will you adapt to the industry changes or be caught out by the shift?

A Strong Business Case With High Revenue Growth Potential

What makes ETFmatic unique is our embedded White-Label solution for financial institutions who want to expand their investment offerings and increase revenue streams but don’t have the internal resources or expertise to do so.

We offer our deep experience in the industry, comprehensive product suite, and sophisticated technology platform, enabling us to deliver tailored solutions for all types of clients.

Profitable Business Extension

Investment-as-a-Service models enable ETFmatic partners to generate additional revenue from existing client bases.

Faster time to market

Agile turnkey solution with the required regulatory permissions, technology solution and operations with quick time to market

benefits

Get past barriers with ETFmatics embedded investment solutions

ETFmatic offers a range of investment solutions to help you overcome barriers. Whether you’re a bank or fintech, we provide customized solutions that allow you to seamlessly integrate our products with your existing operations.

A wide range of products designed to meet your customers’ needs.

Automate operations and trading processes to reduce the costs of running your business and offer clients more competitive fees.

ETFmatic can help companies shorten the time-to-market of new products by using its solutions instead of developing them in-house.

regulated by MIFID II, AML and PSD2; Fully authorised, and banking licensed that allows our partners to operate in European Economic Area

Everything you need to offer investment solutions

To stay competitive in financial industry prepaid debit cards or onboard funds are no longer unique.

But, ETFmatics back-to-front stack investment solutions allows you to create your own investment offering, differentiating your product from competitors.

Increased engagement and client retention

Customers appreciate checking investments, as this can be more exciting than checking a bank account balance. This also enables more personal communication with clients.

ETFmatics offering helps financial institutions attract new clients and retain existing ones by connecting emotionally with their long term financial goals and hopes.

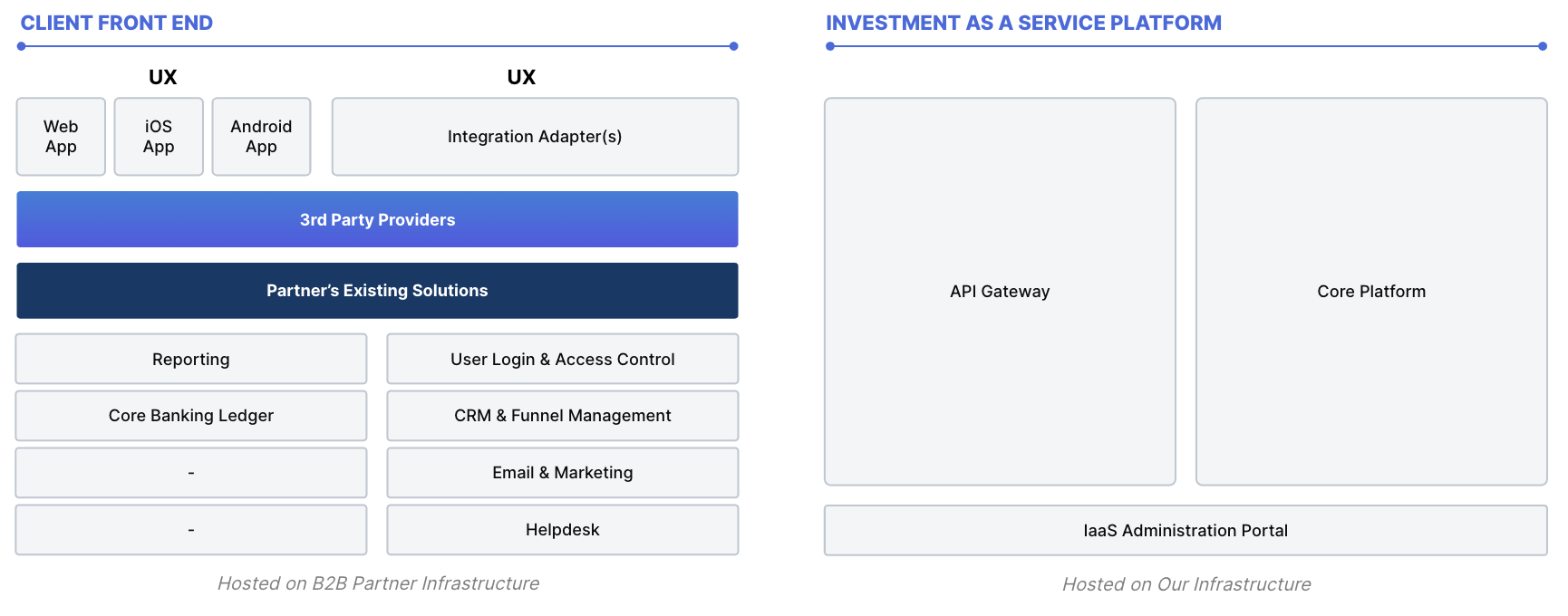

ETFmatic Solution architecture

And, we have full banking licenses powered by Aion in Belgium, Germany, and Poland that allow us to provide services in 32 countries to get you up and running in no time.

- Carry on a regulated activity

- Hold client money

- Arrange deals in investments

- Deal in investments as an agent

- Make arrangements with a view to transactions in investments

- Safeguard and administer assets

- Passport across Europe

Add Your Heading Text Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.