One of the core philosophies of ETFmatic is our obsession with transparency. We publish our whitepaper to tell you how we manage your money. We compare our fees to others and we show you exactly what ETFs we are going to invest in. Another big focus is to ensure that we make investing as straightforward as possible. This means that anyone, across the 32 European countries we serve, can open an account and fund their portfolio with as little as GBP/USD/EUR 100. An industry low. Further, to enable you to fund your portfolio as simple as possible, we provide four options: bank transfers, direct debits, debit cards and TransferWise – for those of you looking to save on currency transactions fees when you fund a GBP portfolio using a bank account in another currency.

We have many clients that have taken advantage of these features. Some of them have decided to try us out with a small monthly direct debit which we wholeheartedly encourage. Investing consistently over the long-term, no matter how small, can provide returns to investors. We always allocate funds as accurately as possible to build the asset allocation that our clients selected (the target asset allocation). However, as the ETFs we buy have market prices and our portfolios are driven by the asset allocation (and risk profile) selected, invariably we have to buy enough of the ETFs in the right proportion in order to reach the target asset allocation. This might seem like an obvious point, yet for a balanced portfolio to have all the correct weights of asset classes (ETFs) enough has to be invested in order to buy all the ETFs. We can’t buy fractional shares of ETFs, which means we can’t allocate small investment amounts across all the required ETFs.

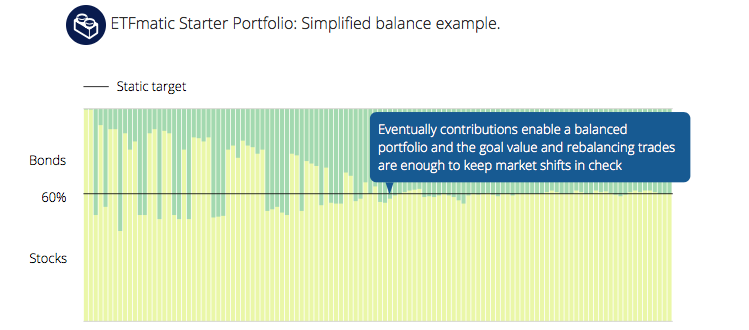

Whenever our clients create a goal, we stipulate the minimum investment required in order to ensure that we can build that asset allocation in full. We would classify a portfolio that is on target, or invested in full, as a balanced portfolio1. Having a balanced portfolio is important as it will provide investors with the risk and return objectives (the target asset allocation) they initially selected. Therefore, any portfolio that has not been able to buy all the required ETFs in the right proportions is out of balance and will have different risk and return characteristics. Given our focus on simplicity and transparency, we are releasing new functionality today to notify and help clients track how long we expect it will take for their current funding to result in a balanced portfolio.

Let’s take a simple example of a starter portfolio with an equity and bond allocation. Investing EUR 100 a month can be great, however, it is important to note that it will take some time before the portfolio will match your objectives. The first EUR 100 would be allocated to the most underweight asset classes that can be purchased, given the market prices of the ETFs. In our hypothetical portfolio, we would invest the initial EUR 100 into one share of Vanguard’s EUR Government bond ETF (EUR 24.98), one share of Vanguard’s S&P 500 ETF (EUR 43.46) and one share of iShares FTSE 100 ETF (EUR 8.61). As we detailed in our how we invest cash post, these asset classes/ETFs would present two characteristics relevant for the construction of such hypothetical portfolio: (i) being the most underweight and (ii) being purchasable given the capital invested. The iShares EURO Inflation Linked Bond ETF with a current market price of EUR 209.76 (as of 18 January 2018) will, for obvious reasons, not be bought given the EUR 100 invested.

Every month we would repeat the same process, purchasing what ETFs we can be given the underweight allocations and what is affordable. This means that the ETFs bought will not necessarily match the combination of ETFs required to meet a target asset allocation until the amount invested is large enough. What you actually hold will differ from the portfolio initially selected.

We’ve always wanted to make it easy to invest and have low minimum investment amounts to help ensure anyone can get started. We also want to make sure that our clients are always aware of the risk they are taking with their investments. Starting small is great, however we believe it is as important to be aware that your portfolio won’t match your risk and return objectives. We hope this will help our clients decide what funding amount and consistency match their need to have a balanced portfolio. Clients can then decide to either continue their funding cycle, or adjust where accordingly to reach a balanced portfolio. As Donna Karan said, everything in life has to have balance. Investing is no different.